Despite Market Correction, Peter Brandt Is Positive About Bitcoin

Peter Brandt Bitcoin breakout In the volatile world of cryptocurrencies, Bitcoin has become the centre of intense speculation and analysis. Despite experiencing a recent dip in its price, renowned trader Peter Brandt remains optimistic about Bitcoin’s trajectory. This article delves into the insights provided by Brandt. Exploring why he believes that Bitcoin’s market conditions are not indicative of a bearish trend but rather a setup for a significant bullish breakout.

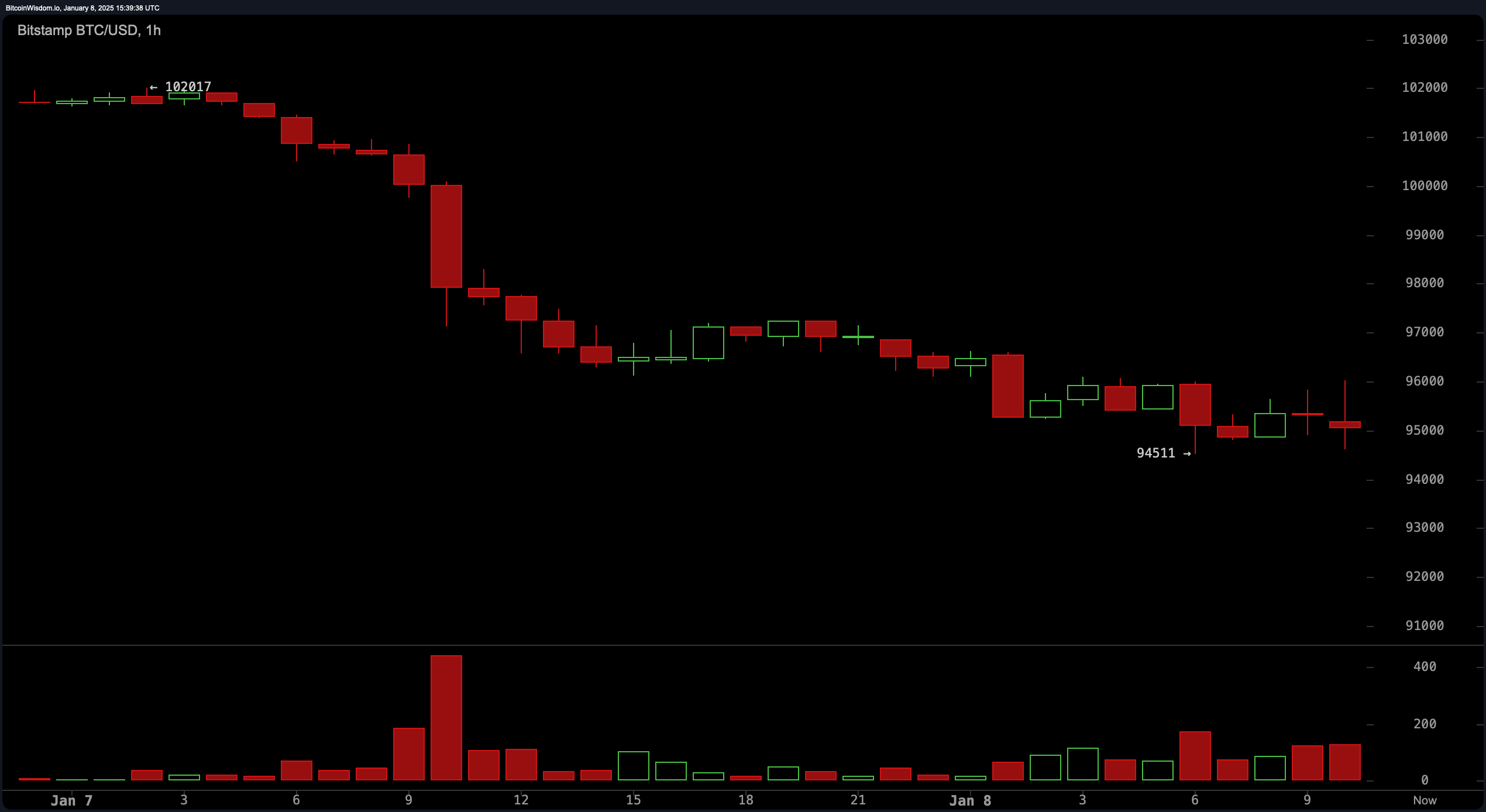

Market Correction Hits Bitcoin

Bitcoin’s historic drop from $108,200 to $95,000 last week. As U.S. bond yields rose, this decline occurred. Which jumped after stronger-than-expected job vacancy data signalled the Fed would stay hawkish. Despite his 40-year trading career, Peter Brandt says. Bitcoin is volatile, especially in response to macroeconomic factors like bond market changes. Despite these short-term fluctuations, Brandt’s analysis implies Bitcoin’s long-term trend is upward.

Brandt’s Technical Analysis

Brandt’s optimism Brandt’s from his interpretation of Peter Brandt Bitcoin breakout price Bitcoin’s points out. Bitcoin is currently forming a head-and-shoulders pattern on the daily chart, which might be misleading. If one only considers this short-term pattern.

However, when looking at the weekly chart, a different picture emerges. Brandt identifies a cup-and-handle pattern, typically a bullish continuation pattern, indicating that Bitcoin might prepare for a breakout. He argues that Bitcoin broke out from the handle of this pattern in November, which led to its record high in December. The recent decline, therefore, could be seen as a consolidation or a setup for another upward movement.

Moving Averages Signal Strength

Moreover, Brandt emphasizes the importance of Bitcoin’s position and its moving averages. He notes that Bitcoin is still trading above its 50-day moving average, often seen as a sign of underlying strength. This position suggests that the market sentiment, while shaken by recent events, has not turned bearish.

Brandt forecasts that. If Bitcoin can maintain this level and continue its pattern, it might be heading towards a significant breakout, potentially reaching $122,000 soon. This prediction is based on the classical measurement of the cup-and-handle pattern’s depth, propattern’swards from the breakout point.

The timing of this potential breakout could be influenced by several external factors. Including political events like Donald Trump’s upcoming inauguration. Brandt suggests that such events could catalyze market movements, possibly pushing Bitcoin’s price upwards Bitcoin’s owners look to cryptocurrencies as a hedge against potential economic policies or instability.

Bullish vs. Bearish Views

The broader context of Brandt’s analysis is Brandt’s general market sentiment across social platforms. Posts on X have echoed this bullish outlook, with many traders and analysts discussing Bitcoin’s resilience despite recent market weakness. These posts highlight a belief that the current correction is a buying opportunity rather than a signal to exit the market.

However, not all traders and analysts share Brandt’s optimism. Some cautioned that Brandt’s the bond market’s influence, particularly. The upcoming Federal Reserve minutes and nonfarm payroll numbers could lead to further volatility or a sustained downward trend if the macroeconomic environment continues to deteriorate.

Bitcoin’s Resilience

Critics argue that while patterns like the cup-and-handle are noted, no pattern can predict market movements with absolute certainty. Especially in a market as nascent and speculative as cryptocurrencies. Despite these concerns. The resilience of Bitcoin’s blockchain technology is showing acceptance as a store of value rather than just a medium of exchange.

The continual evolution of its infrastructure provides a solid foundation for Brandt’s bullish perspective. Brandt’s introduction of second-layer networks like the Lightning Network, which aims to handle transactions more efficiently, further supports the argument for Bitcoin’s long-term viability and its potential for price appreciation.

In Conclusion

While the recent weakness in Bitcoin’s price might unnerve Bitcoin’s investors, Peter Brandt’s analysis offers a counterpoint, pointing to technical patterns and market history. His insights suggest that the current dip is merely a blip in what continues to be an overwhelmingly bullish long-term trend for Bitcoin. Investors are advised to consider the broader market dynamics.

The potential for political catalysts and Bitcoin’s fundamental strengths when making investment decisions. As the legendary trader points out, patience and a keen eye on both micro and macroeconomic indicators could well pay off in the world of Bitcoin.